To Turn the Porter's Nail on Its Head...

- Senthil Kumar

- Mar 27, 2016

- 3 min read

In my recent posts, I have traced the reasons for failure of capital markets to help efficiently allocate stock investments to firms, and how this leads to stock market volatility, lesser returns to long term investors, and enticing of corporate management to seek short-term equity returns at the cost of long-term performance.

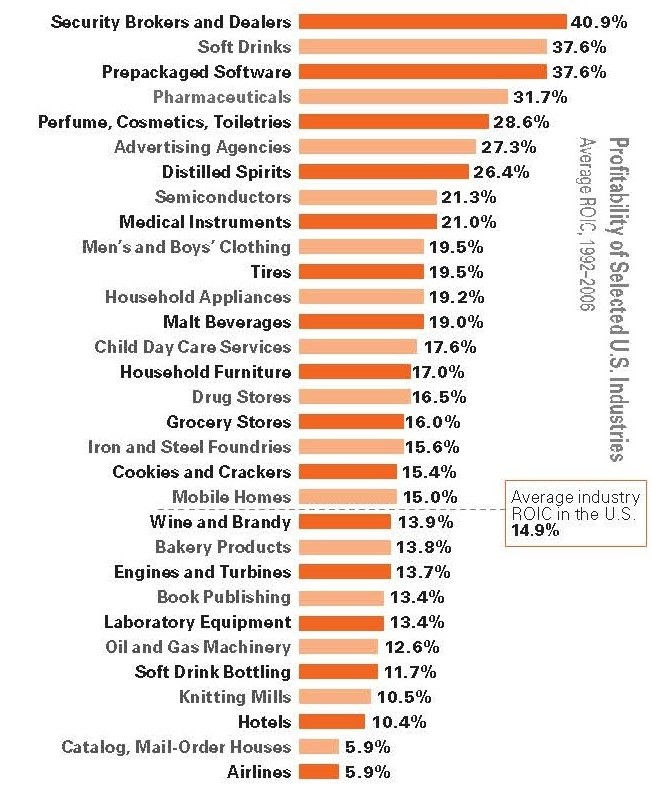

In this article, I would like to draw your attention to the most popular study done by the Strategy Guru Michael Porter on profitability (measured as ROIC- see the chart that appears like a nail) of selected US. industries between 1992-2006. While the wider variance of profitability (from 5.0% to 40.0%) the study portrays is attributed to Porter's famous model of unfriendly industry forces such as intensity of rivalry, bargaining power of buyers & suppliers, barriers to new competition, and threat of substitutes, I would like to seek your close attention to industries that are in the top 30 percentile and and those in bottom 30 percentile.

One major rationale sticking out of this data is the extent of research, capital and labor intensiveness (as a percentage of sales) that afflicts the profitability of industries, especially those listed in the bottom of this chart. Albeit many of those industries in top of the chart happens to be that of fast moving consumer goods with less research, capital or labor requirements than those in the bottom, interestingly, however,when the whole of US economy was in trouble for most period in that time range (1992-2006), those in the top of the list seemed to have enjoyed tremendous profitability.

If a similar study done for the period between 2000 and 2015, the results would exhibit the same pattern except that the 'nail will be more taper and sharper' with more industries at the bottom.' Fortunately, the oil prices were down for the last 4 years saving the most of the US. economy.

It is not surprising, however, that stock brokerage firms and dealers were most profitable given the high degree of stock volatility and shorter-term investment-driven financial markets. Higher return in stock brokerage industry does not mean that investments did well in the overall economy, nor the capital dividends did flow to investors; rather, the higher returns in financial and security industry portray more of velocity and short-term ebb and flow of capital into markets (what is referred to as volatility).

This data raises a serious debate and questions whether the profitability differences should be simply explained away with a 'conformist school of thought' that free markets efficiently determine the impact of industry forces based on respective demand and supply conditions of industries, and that industry forces change over time and there is dynamic equilibrium in industries which will reduce the skew in their profitability over time.

There are some views which argue that firm-specific strategies and resources can offset the industry impact and the firm level performance will guide the investors rather than industry factors. However, a systemic skew in industry profitability - favoring some industries and disfavoring several others for a such a long periods of time demands serious interventions from both government and corporate management to ensure the stakeholders in afflicted industries with fair returns, wages and standard of living. For example, agriculture, steel, airlines, automobiles are some industries where most of the companies, if not all, perennially suffer from unfavorable industry conditions and loss, and in turn do not attract investors' interests.

While governments would be expected to respond with subsidies and tax incentives, companies on their part need to devise innovative corporate strategies. With such scenario, in many cases especially in developing economies, even governments have to reenter some industries, if not nationalize or core sectors like oil and energy.

The trodden path of mergers and acquisitions or vertical / horizontal integration would be of less help. Firms need to band together to influence the government and investors, and seek concessions to control input prices (such as oil, energy) and government investments in stocks and bonds to stabilize the capital asset prices. Right sizing of the firms and dis-aggregating the value chain would be another important change needed in the organizational configuration of firms in these industries.

Please refer to my LinkedIn articles "Shoaling as Competitive Strategy" (https://www.linkedin.com/pulse/shoaling-school-fish-competitive-strategy-senthil-kumar) and

(https://www.linkedin.com/pulse/shoaling-school-fish-knowledge-era-corporate-strategy-senthil-kumar)

Financial Markets, Corporate Governance and Efficiency or lack thereof (https://www.linkedin.com/pulse/markets-governance-efficiency-lack-thereof-senthil-kumar-muthusamy?trk=pulse_spock-articles)

Comments